How the Best Bookkeeper Calgary saves your business time and money

Discover the Crucial Duty of a Bookkeeper in Small Service Success

In the competitive landscape of small service, the role of an accountant commonly goes undetected yet stays important. They offer crucial solutions that guarantee financial precision and compliance. Effective bookkeeping can brighten a service's monetary wellness, leading owners toward educated decision-making. Lots of owners overlook this key source. Comprehending the full impact of an accountant's know-how reveals opportunities that can considerably influence the trajectory of a company's success. What might be prowling in the numbers?

Recognizing the Fundamentals of Bookkeeping

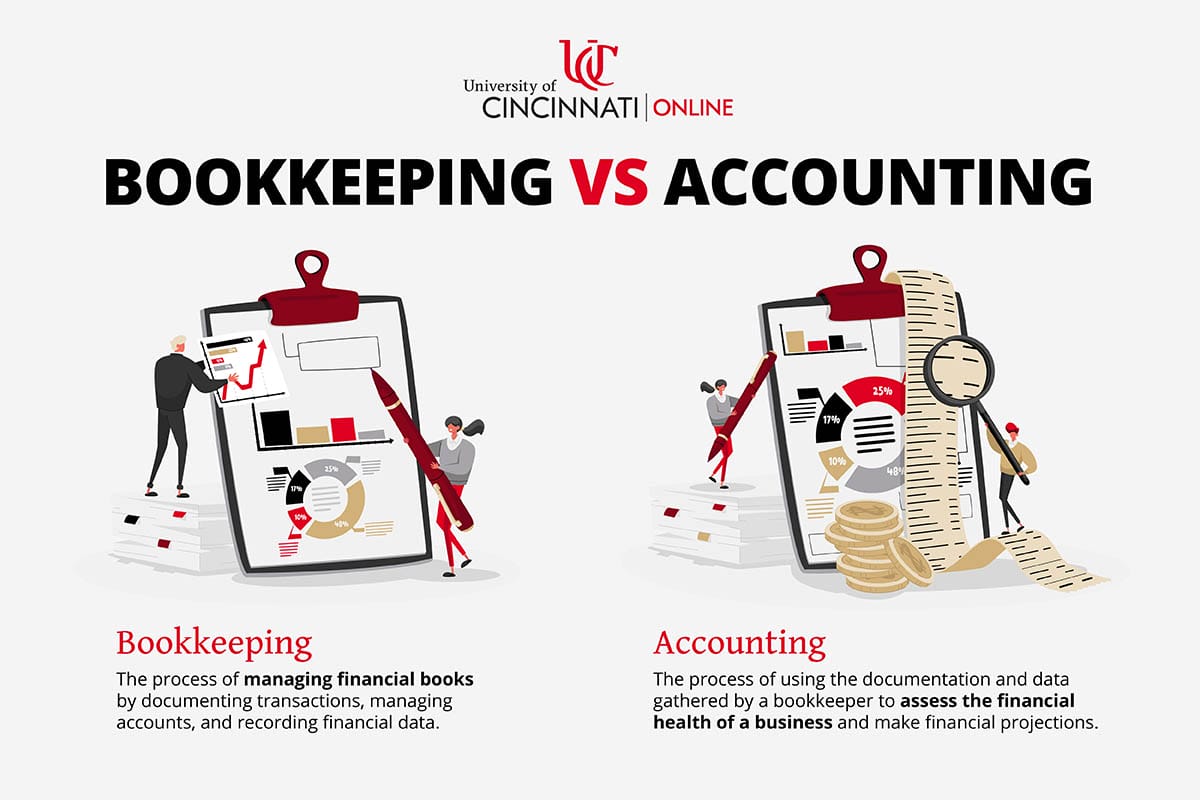

Although lots of small company owners might see accounting as a tedious task, comprehending its fundamentals is essential for preserving financial wellness. Bookkeeping entails methodically recording financial transactions, which lays the groundwork for notified decision-making. At its core, it includes monitoring income, responsibilities, expenses, and assets. By carefully maintaining these documents, small company owners can gain understandings right into their monetary performance and money flow.

Furthermore, understanding the basics of accounting assists in planning for tax obligation obligations and guaranteeing conformity with regulations. Familiarity with financial statements, such as income statements and equilibrium sheets, permits company owner to examine productivity and financial stability (Bookkeeping Calgary). Implementing effective bookkeeping methods can lead to much better budgeting and forecasting, inevitably adding to long-lasting success. Subsequently, spending time in comprehending bookkeeping essentials outfits tiny company proprietors with the necessary tools to browse their monetary landscape successfully, eventually enhancing their total business acumen

The Financial Checkup: Why Accurate Records Matter

Precise economic documents serve as the foundation of a tiny business's financial health and wellness. They give a clear image of a firm's revenue, expenditures, and total success. By preserving precise documents, local business owner can recognize patterns, take care of capital, and make educated decisions. Errors in economic documentation can lead to pricey mistakes, misinformed techniques, and possible legal problems.

Regular economic checkup, helped with by a proficient bookkeeper, warranty that disparities are addressed promptly, fostering confidence amongst stakeholders. Additionally, accurate documents are crucial for tax obligation prep work, helping avoid charges and taking full advantage of reductions.

Reliable financial data can boost a business's integrity with capitalists and loan providers, leading the means for future growth chances. Ultimately, prioritizing accurate record-keeping not only safeguards a company's current status but additionally prepares for lasting success.

Budgeting and Forecasting: Planning for Success

Effective budgeting and projecting are necessary devices that equip local business owners to browse their monetary landscape with confidence. By developing a clear economic plan, organizations can assign sources efficiently, anticipate future costs, and recognize prospective income streams - Bookkeeping Services Calgary. A well-structured budget functions as a roadmap, leading decision-making and ensuring that business remains on course to satisfy its economic objectives

Forecasting enhances budgeting by providing forecasts based upon historic data and market patterns. This anticipating analysis allows small companies to prepare for variations in cash money flow and change their strategies as necessary. On a regular basis updated forecasts help owners make informed selections concerning financial investments, hiring, and development possibilities.

Together, budgeting and projecting make it possible for local business to seize and reduce dangers development possibilities, ultimately adding to lasting success. Involving an accountant to assist in these processes can enhance accuracy and integrity, ensuring that the monetary structure is educated and solid.

Tax Compliance and Prep Work: Keeping You Educated

A strong economic plan not only includes budgeting and forecasting however additionally reaches tax compliance and prep work. For small companies, understanding tax responsibilities is crucial to stay clear of fines and ensure financial health. A bookkeeper plays a crucial duty in this procedure by keeping precise records of earnings, costs, and deductions, which aids in exact tax obligation filings. They remain upgraded on tax obligation laws and laws, ensuring business adhere to local, state, and government demands.

Furthermore, accountants assist identify tax-saving possibilities, encouraging on allowable deductions and credit histories that can favorably influence the lower line (Best Bookkeeping Calgary). By preparing tax obligation returns and taking care of target dates, they reduce stress and anxiety for company owner, permitting them to focus on operations. With their know-how, local business continue to be notified about their tax obligation standing, cultivating a positive approach to financial administration and long-lasting success

Financial Coverage: Making Informed Service Choices

Precise financial information is vital for small companies, functioning as the structure for audio decision-making. The timing and regularity of economic reporting play substantial functions in ensuring that company owner have access to relevant information when they need it. By leveraging data-driven understandings, businesses can navigate obstacles and take chances better.

Relevance of Accurate Information

Timing and Frequency Matters

Timeliness and frequency in monetary reporting are essential for efficient decision-making in small companies. Routine economic records guarantee that company owner have access to current info, allowing them to react swiftly to altering market conditions. Quarterly or month-to-month coverage enables for ongoing assessment of monetary performance, highlighting patterns and potential concerns prior to they rise. This organized strategy not just help in capital monitoring however also supports budgeting and forecasting efforts. Furthermore, prompt reports foster openness and liability within the organization, boosting stakeholder depend on. Without constant economic oversight, small organizations risk making unenlightened choices that might threaten their development and sustainability. As a result, developing a reputable coverage timetable is essential for maintaining a healthy economic overview.

Data-Driven Choice Making

How can local business prosper in an affordable landscape? By leveraging data-driven decision-making, they can accomplish substantial development and functional efficiency. Exact financial reporting, facilitated by competent accountants, gives vital insights right into profits patterns, expenditures, and cash circulation. This info empowers local business owner to determine trends, allocate sources wisely, and readjust methods in real-time.

Timely monetary records enable small companies to forecast future performance and make notified choices concerning financial investments and cost-cutting efforts. Consequently, the capacity to examine and analyze monetary information ends up being a keystone of strategic preparation. Ultimately, organizations that harness the power of information are much better placed to navigate obstacles and confiscate chances, guaranteeing long-term success in a vibrant market.

Enhancing Operations: The Efficiency of Outsourcing

As companies endeavor for efficiency and development, outsourcing specific operations has actually arised as a strategic remedy that can considerably streamline processes. By entrusting non-core jobs, such as bookkeeping, to customized companies, small companies can concentrate on their primary goals. This technique reduces above costs, as employing in-house team typically involves incomes, advantages, and training costs.

Outsourcing allows access to know-how that might not be available inside, ensuring that jobs are done with a high level of competence. Furthermore, it enhances adaptability, making it possible for organizations to scale operations up or down based upon demand without the problem of permanent staffing changes.

Outsourcing can boost turn-around time for essential features, as outside carriers often have actually developed systems and sources in place. Generally, this calculated step not just improves operational performance but also positions local business for lasting development, permitting them to assign resources better.

Building a Partnership: Collaborating With Your Accountant

Efficient collaboration with an accountant depends upon solid communication and clearly specified expectations. By establishing a clear dialogue, company owners can harness beneficial monetary insights that drive informed decision-making. This collaboration not just boosts monetary administration yet additionally adds to the general success of business.

Interaction Is Trick

Developing a solid line of communication between an entrepreneur and their accountant lays the foundation for an effective monetary partnership. Open up discussion fosters transparency, permitting both events to share important info pertaining to financial goals, obstacles, and approaches. Routine conversations make it possible for the bookkeeper to comprehend business dynamics and tailor their services as necessary. Additionally, prompt updates on economic matters can assist the proprietor make informed decisions. Energetic listening is crucial; it guarantees that both the organization owner and bookkeeper feel valued and understood. This joint approach not only enhances depend on yet additionally leads to more reliable problem-solving. Eventually, keeping consistent interaction parties both empowers to adjust to altering conditions, driving the company toward continual success.

Establishing Clear Assumptions

Clear assumptions act as an important part in promoting an efficient partnership between an entrepreneur and their bookkeeper. By developing details responsibilities and deadlines, both parties can straighten their goals and top priorities. It is more info necessary for entrepreneur to verbalize their requirements plainly, consisting of the frequency of records and the degree of detail required. Bookkeepers need to communicate their procedures and any restrictions upfront. This good understanding helps protect against misconceptions and warranties timely financial monitoring. Routine check-ins can also strengthen these expectations, enabling for modifications as the business develops. Ultimately, setting clear expectations cultivates depend on and responsibility, making it possible for an unified partnership that supports the overall success of the service.

Leveraging Financial Insights

While many service proprietors might view their accountants entirely as number crunchers, leveraging financial insights can transform this relationship right into a critical collaboration. By actively collaborating with their accountants, local business proprietors can acquire a deeper understanding of their economic wellness and make educated choices. Bookkeepers possess important know-how in determining fads, managing cash circulation, and maximizing budget plans. Routine communication allows for the sharing of insights that can highlight chances for growth or cost-saving measures. Additionally, bookkeepers can assist in establishing reasonable financial goals and tracking progress, making certain that company owner continue to be answerable. Inevitably, promoting this partnership equips small company owners to browse challenges better and confiscate chances for long-lasting success.

Often Asked Concerns

What Qualifications Should I Look for in an Accountant?

When looking for an accountant, one ought to prioritize qualifications such as appropriate certifications, effectiveness in accountancy software, strong focus to information, and experience in handling monetary documents, making certain compliance with policies and assisting in exact economic reporting.

How Typically Should I Consult With My Bookkeeper?

Meeting an accountant monthly is normally recommended, permitting for timely updates on monetary standing and any kind of needed modifications. More regular conferences may be valuable throughout hectic periods or when substantial adjustments occur.

Can a Bookkeeper Aid With Payroll Handling?

Yes, a bookkeeper can aid with payroll processing. They manage employee documents, calculate incomes, and guarantee precise tax obligation reductions, aiding services maintain conformity and enhance pay-roll procedures successfully, thus lowering the administrative worry on proprietors.

What Software Tools Do Bookkeepers Generally Use?

Bookkeepers typically use software tools such as copyright, Xero, FreshBooks, and Sage. These systems facilitate accounting tasks, simplify financial coverage, and improve overall performance, enabling accountants to manage financial records efficiently for their clients.

Exactly how Do I Select In Between Employing Outsourcing or in-house Bookkeeping?

Familiarity with monetary statements, such as earnings statements and equilibrium sheets, permits business owners to evaluate profitability and financial stability. Accurate financial documents offer as the backbone of a small service's financial health. Establishing a strong line of communication in between a company owner and their bookkeeper lays the foundation for an effective monetary collaboration. By proactively teaming up with their accountants, small organization owners can gain a much deeper understanding of their economic health and make notified choices. Furthermore, accountants can aid in setting practical economic goals and tracking progress, ensuring that business proprietors remain answerable.